PureTech established the underlying programs and platforms that resulted in 29 therapeutic and therapeutic candidates generated from PureTech's R&D engine, including three taken from inception at PureTech to FDA approval.

PureTech established the underlying programs and platforms that resulted in 28 therapeutic and therapeutic candidates generated from PureTech's R&D engine, including two taken from inception at PureTech to FDA and EU regulatory clearances a third soon filing for FDA approval.

Core Programs

Legacy Holdings

1As of March 22, 2023, PureTech has sold its right to receive a 3% royalty from Karuna to Royalty Pharma on net sales up to $2 billion annually, after which threshold PureTech will receive 67% of the royalty payments and Royalty Pharma will receive 33%. Additionally, under its license agreement with Karuna/BMS, PureTech retains the right to receive milestone payments upon the achievement of certain regulatory approvals.

Note: Portfolio comprises (1) the Company’s current and future therapeutic candidates and technologies that are developed by the Company's wholly-owned subsidiaries, whether they were announced as a Founded Entity or not, and will be advanced through with either the Company's funding or non-dilutive sources of financing, and (2) companies founded by PureTech in which PureTech maintains ownership of an equity interest and, in certain cases, is eligible to receive sublicense income and royalties on product sales. Relevant ownership interests for Celea Therapeutics, Gallop Oncology, Inc., Seaport Therapeutics, Inc., and Entrega, Inc. were calculated on a partially diluted basis (as opposed to a voting basis) as of June 30, 2025, and for Sonde Health, Inc. as of August 27, 2025 including outstanding shares, options and warrants, but excluding unallocated shares authorized to be issued pursuant to equity incentive plans. Sonde Health, Inc. completed a modest convertible debt financing in July 2025, which, if converted in a future financing, could further dilute PureTech’s position from what is noted here. Ownership interests for Vedanta were calculated on a fully-diluted basis as of August 27, 2025. PureTech controls Gallop Oncology, Inc. and Celea Therapeutics.

Note: Portfolio comprises (1) the Company’s current and future therapeutic candidates and technologies that are developed by the Company's wholly-owned subsidiaries, whether they were announced as a Founded Entity or not, and will be advanced through with either the Company's funding or non-dilutive sources of financing, and (2) companies founded by PureTech in which PureTech maintains ownership of an equity interest and, in certain cases, is eligible to receive sublicense income and royalties on product sales. Relevant ownership interests for Celea Therapeutics, Gallop Oncology, Inc., Seaport Therapeutics, Inc., and Entrega, Inc. were calculated on a partially diluted basis (as opposed to a voting basis) as of June 30, 2025, and for Sonde Health, Inc. as of August 27, 2025 including outstanding shares, options and warrants, but excluding unallocated shares authorized to be issued pursuant to equity incentive plans. Sonde Health, Inc. completed a modest convertible debt financing in July 2025, which, if converted in a future financing, could further dilute PureTech’s position from what is noted here. Ownership interests for Vedanta were calculated on a fully-diluted basis as of August 27, 2025. PureTech controls Gallop Oncology, Inc. and Celea Therapeutics.

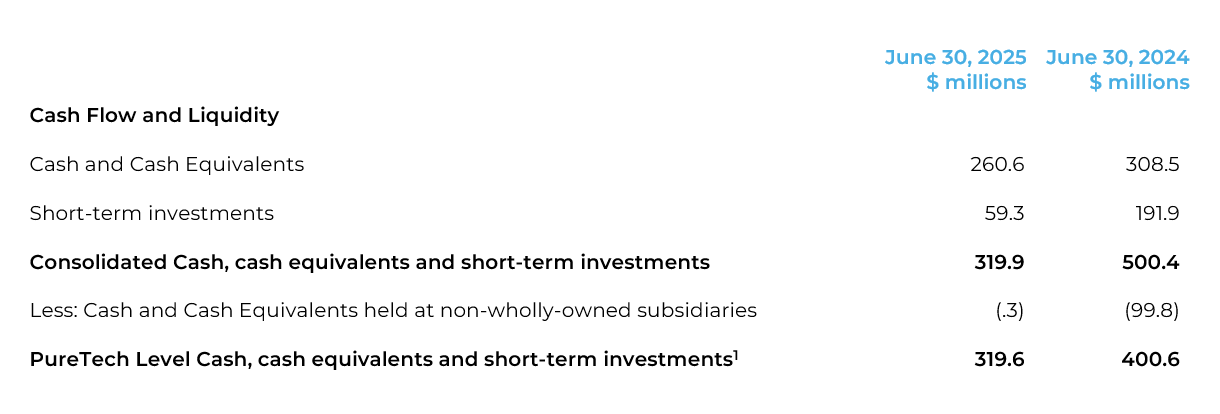

PureTech Level Cash, Cash Equivalents & Short-Term Investments

$319.6M

PureTech Level Cash, Cash Equivalents and Short-Term Investments as of June 30, 20251

1 This represents a non-IFRS number and is comprised of Cash, cash equivalents and short-term investments held at PureTech Health plc and our following wholly-owned subsidiaries: PureTech LYT, Inc., PureTech LYT 100, Inc., Alivio Therapeutics, Inc., PureTech Management, Inc., PureTech Health LLC, PureTech Securities Corp., PureTech Securities II Corp. For a reconciliation of this number to the IFRS equivalent number, please refer to the "Non-IFRS Financial Information” slide of our corporate presentation.

Developing breakthrough medicines at PureTech